If your spa accepts tips, 2025 marks the most significant change we’ve seen in years. A new federal law introduces a temporary deduction for reported tips and expands certain employer payroll tax credits to beauty and personal care businesses. Great news—if you’re documenting correctly.

In this post, we’ll break down what’s new, who qualifies, what to do next, and the cleanest way to keep your spa compliant without creating busywork.

*This article is for educational purposes only and not tax or legal advice. Always consult your CPA or tax attorney about your specific situation.

Quick summary (read this first)

What changed in 2025: the essentials

1) A new federal tip deduction for eligible employees (2025–2028)

For the 2025–2028 tax years, eligible workers in occupations that “customarily and regularly” receive tips may deduct up to $25,000 in reported tips from federal taxable income each year. (If self‑employed, the deduction is limited to the net income from the business where the tips were earned.) The deduction phases out at higher incomes; most guidance points to a phase‑out beginning around the $150,000 range for single filers (with a higher threshold for joint filers). Exact thresholds and definitions are subject to Treasury/IRS guidance.

Key implications for spa teams:

- This is a deduction (not a credit), so it reduces taxable income—not dollar‑for‑dollar tax owed.

- Reported is the operative word. Unreported tips won’t qualify.

State taxes: Your state may not mirror the federal rules; check with your CPA.

2) An expanded employer payroll tax credit on credit/debit‑card tips

Historically, restaurants could claim a FICA tip credit that offsets part of the employer’s share of payroll taxes on employees’ reported tips. In 2025, that framework was expanded to include beauty and personal care businesses (salons, spas, barbershops). This is a significant cash-flow relief for owners who process card-based tips through payroll.

What this means for owners:

- If you process tips through payroll and employees report tips accurately, you may be able to reclaim part of the employer payroll tax paid on those tips.

- You’ll need clean reporting that ties out to payroll records.

- Your CPA will determine filing specifics and whether you qualify.

Bottom line: Both provisions reward spas that report tips accurately. The fastest path to compliance is to centralize tipping, payout, and reporting in one system.

Who qualifies?

Employee side (the service provider)

You’re likely eligible if:

- You work in a role that customarily receives tips (aesthetician, nail tech, massage therapist, stylist, etc.).

- Your modified adjusted gross income is below the phase‑out thresholds (varies by filing status; speak with your CPA).

You report tips through your employer or properly on your return if self‑employed.

You’re not eligible if:

- You fail to report tip income.

- You’re above the income thresholds or file in disallowed statuses (e.g., some provisions exclude married filing separately).

Your role is not in a “customarily tipped” occupation (Treasury will clarify occupations).

Employer side (spa owner)

You may qualify for the payroll tax credit if:

- Your business is a salon, spa, med spa, or similar beauty/personal care employer with tipped employees.

- You process and report employees’ tips through payroll.

You keep auditable records that reconcile POS/PMS tip logs to payroll and bank deposits.

Compliance made simple: the 5‑layer tip system

You don’t need a bigger back office—you need a clean, repeatable system. Here’s a five‑layer setup we recommend to Growth Factor® members:

- Centralize tipping

Use one workflow for all tipping: a kiosk or POS‑integrated screen that presents suggested tip options and assigns tips to specific providers. - Automate deposit & payout

Tips should route directly to provider accounts (typically next business day) while creating a paper trail for payroll and taxes. - Lock in reporting

Generate daily and pay‑period reports showing: ticket #, service provider, gross tip, card/cash indicator, date/time, and payout status. Save PDFs to a monthly “Tip Reporting” folder. - Reconcile to payroll

Match POS/PMS tip totals to payroll journal entries every cycle. Resolve discrepancies before submitting payroll. - Document policies

Create a 1‑page Tip Policy (who can accept tips, how they’re processed, reporting timelines, and staff responsibilities). Acknowledge during onboarding.

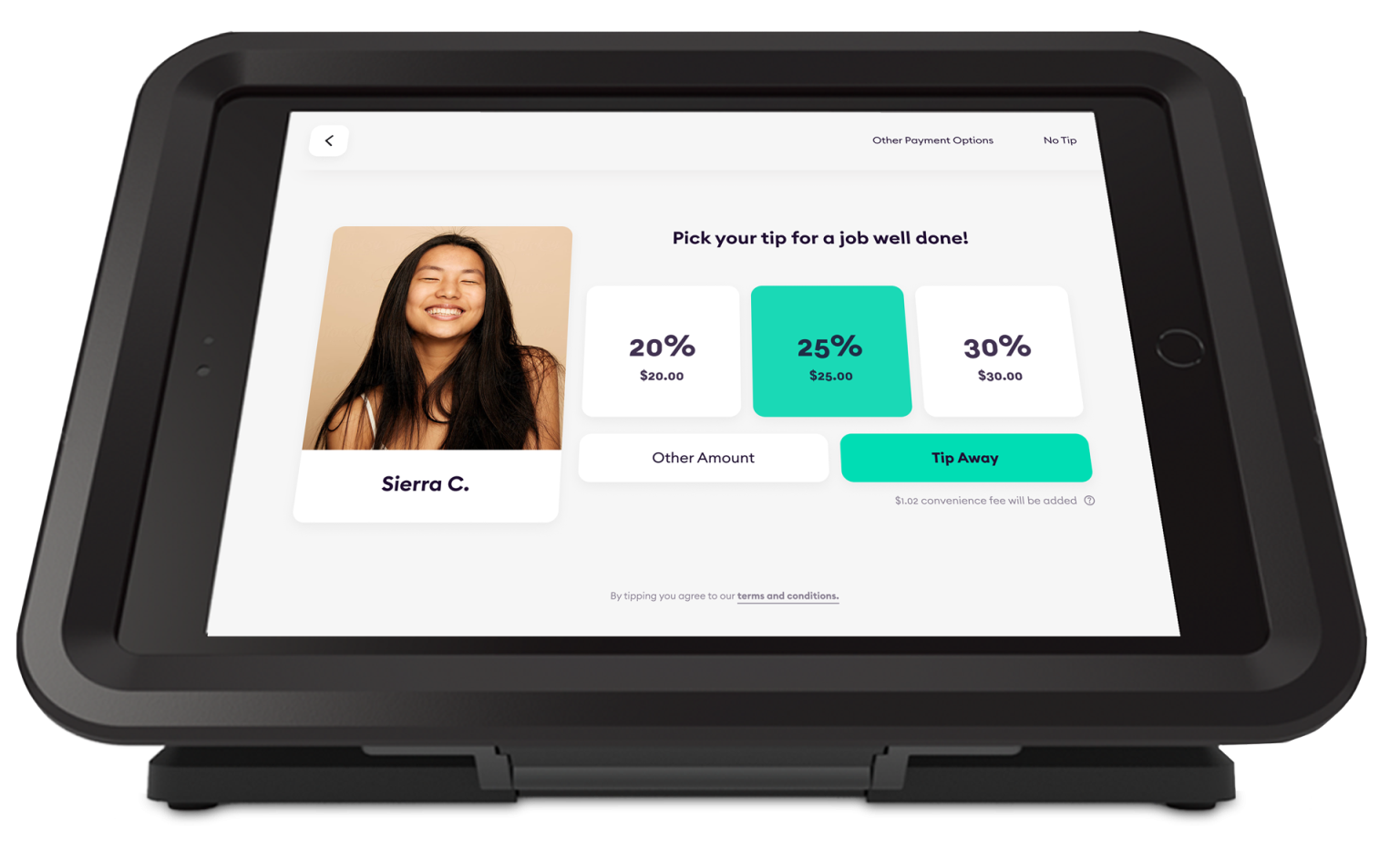

If that sounds like a lot, this is exactly where Tippy shines—hardware + software designed for beauty businesses, with built‑in reporting, next‑day payouts, and card‑based tip options that providers and clients actually prefer.

Why we recommend Tippy (and how to get it free for a year)

Tippy is a salon/spa‑specific tipping platform that makes tip collection, payout, and reporting easy and audit‑ready. Clients tip via a forward‑facing kiosk or integrated POS; funds are deposited to the provider (typically next day), and the system generates the reports your CPA needs. Many teams also see higher tip averages when clients can tip on a card.

Exclusive for our community:

*We do not receive affiliate compensation for this; it’s an extended offer for our audience.

How to roll it out in 7 days

- Day 1–2: Order your Tippy hardware; pick your suggested tip options.

- Day 3: Add a “How tipping works here” card at reception.

- Day 4: Train front desk on the short “Tippy script” (see below).

- Day 5: Test deposits & reports; set your payroll mapping.

- Day 6–7: Go live; review your first daily report and file it.

Front desk script (60 seconds)

“After your service, you’ll see a gratuity screen at checkout. It lets you leave a gratuity for your provider directly; gratuities usually reach them the next day, and you’ll receive your emailed receipt. If you prefer cash, that’s fine too—we’ll make sure it’s recorded so your provider gets full credit. Any questions for me?”

Action plan for spa owners (start now)

Use this 3‑phase plan to get compliant before the busy season hits.

Phase 1 — Decide & document (Week 1)

- Choose one tip platform (we recommend Tippy).

- Publish your Tip Policy (acceptance, processing, reporting, audit).

- Create a Tip Reporting folder with subfolders by month; save daily PDF reports.

Phase 2 — Integrate with payroll (Week 2)

- Map tip types (card vs cash) to your payroll codes.

- Confirm who enters tips (front desk vs providers) and when (end‑of‑day).

- Run a mock payroll to validate the reconciliation.

Phase 3 — Train & monitor (Week 3)

- Host a 30‑minute team training on the new law + your policy.

- Add a weekly checklist: confirm deposits, reconcile to payroll, file reports.

- Review tip averages and show any lift to keep morale high.

FAQs for 2025 spa tip taxes

Do tips still count for payroll taxes?

Yes. Tips are still subject to payroll (FICA) taxes. The new employee‑side relief is a federal income tax deduction on reported tips. Owners may also qualify for a payroll tax credit on certain reported card tips—ask your CPA.

Do “cash tips” include tips paid by card?

For federal purposes, the law’s definition of “qualified tips” encompasses tips paid in cash, by card, or by check, provided they meet the definition of tips and are reported properly.

If I’m self‑employed (solo owner), do I qualify?

Self‑employed individuals may claim the tip deduction up to their net income from the business where tips were earned. Work with your CPA to confirm your specific numbers.

Is there an income limit?

Yes. The deduction phases out at higher incomes (thresholds vary by filing status). Most guidance points to phase‑outs beginning around $150,000 for single filers and higher for joint filers. Your CPA will apply the current IRS rules for your return.

Will my state match the federal rules?

Not necessarily. States set their own income tax rules; many won’t mirror the federal deduction. Confirm with your tax professional.

What records should I keep?

- Daily tip reports from your tipping system/POS

- Payroll journals showing tips processed

- Bank deposits (and payout confirmations)

- Staff acknowledgments of your Tip Policy

How do I talk about this with my team?

Host a short huddle to explain the why (more take‑home pay for providers, cleaner reporting, easier tax prep) and the how (exactly when and how tips are recorded). Reinforce that accurate reporting protects everyone.

Common pitfalls (and how to avoid them)

- Using multiple tip methods (cash + Venmo + side apps) with no central report → choose one system that tracks everything.

- Letting manual tip pools linger → move to automated assignment at checkout; reduce errors and conflict.

- Paying tips late → next‑day payouts motivate teams and simplify cash handling.

- No proof at tax time → if it isn’t documented, it didn’t happen. Save daily PDFs.

The opportunity: higher tips, happier teams, cleaner books

Spas that make tipping easy and transparent tend to see higher tip averages (card‑based options often boost tips), better team morale, and fewer admin headaches. With the 2025–2028 window open, now is the moment to lock in a system that helps your providers keep more of what they earn—and helps you capture any available employer credits.

Ready to implement?

Subscribe to Our Newsletter

Stay up-to-date with our email newsletter to receive important updates, news, and offers!

About the Author

Daniela Woerner is the founder of Addo Aesthetics and creator of the Growth Factor® Framework, a proven system that’s helped hundreds of spa owners build profitable, systemized businesses. With nearly 20 years in the aesthetics industry, she transforms overworked aesthetic professionals into confident Spa CEOs through strategy, systems, and soul-led support. Daniela is also the host of Spa Marketing Made Easy, a top-ranked podcast with over 1 million downloads, where she shares real-world strategies to help spa professionals grow with clarity and confidence.